Cyber Insurance and IT Compliance: What You Need to Know to Get Covered

Cyber Insurance Won’t Help If You’re Not Compliant

Cyber insurance is no longer a nice-to-have. For small and mid-sized businesses, it is often the only financial buffer between a data breach and complete operational shutdown. But here is the part many businesses miss: cyber insurance is not guaranteed coverage.

Insurers are no longer just asking whether you want protection. They are asking how well you protect yourself. If your IT systems and security practices do not meet certain standards, you may face higher premiums, limited coverage, or even denial of your claims.

In other words, if you are not compliant, you are not covered.

This post will help you understand the relationship between cyber insurance and IT compliance. You will learn what insurance providers look for, what steps you need to take to qualify for full coverage, and how to make sure your business is not left exposed.

What Is Cyber Insurance and Why Do You Need It

Cyber insurance is a type of business coverage designed to protect you financially if your systems are hacked, your data is stolen, or you fall victim to ransomware. While traditional insurance covers property or liability, cyber insurance focuses specifically on digital threats and their consequences.

What Cyber Insurance Typically Covers

Most policies help with:

As cybercrime rises and attacks grow more sophisticated, the cost of recovery has skyrocketed. For small businesses in particular, the financial hit from a single breach can be enough to close the doors for good.

According to recent industry reports, the average cost of a data breach for SMBs is now around a million dollars, and that does not include long-term reputational damage.

Why It Is No Longer Optional

Cyber insurance gives you a financial safety net when something goes wrong, but it also provides peace of mind that your business can recover quickly and responsibly. Many vendors, clients, and partners now expect their business partners to have cyber liability coverage in place.

But having a policy is not enough. As we will cover next, you also need to meet strict IT standards to qualify and keep your coverage active.

The Link Between IT Compliance and Insurance Approval

In the early days of cyber insurance, getting a policy was as simple as filling out a form. Today, insurers want proof that your business is actively protecting its systems and data. If you do not meet certain cybersecurity benchmarks, you may face higher premiums, reduced coverage, or outright denial.

Why Insurers Care About Compliance

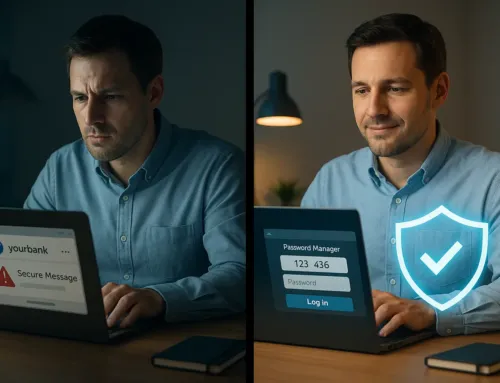

Insurance carriers view poor cybersecurity hygiene the same way car insurers view reckless driving. If you do not follow basic safety standards, you are considered a high-risk client. In the digital world, that means not having proper backups, outdated antivirus tools, weak password policies, or no incident response plan.

Insurers want to minimize their risk. That is why they increasingly tie coverage decisions to your ability to prove IT compliance.

Common Frameworks Insurers Use for Evaluation

While each carrier has its own checklist, many draw from established cybersecurity frameworks, including:

Meeting these standards, or at least demonstrating that you are working toward them, can make a major difference in both your ability to secure coverage and the terms of your policy.

Real-World Consequences

Businesses have had claims denied after ransomware attacks simply because they could not prove they had working backups or had not patched critical vulnerabilities. In other cases, coverage was reduced after it was discovered that employees had not completed basic security training.

Insurers are not trying to catch businesses off guard. They are trying to insure companies that take cybersecurity seriously. That starts with having the right IT practices in place, and being able to prove it.

What Carriers Want to See Before They’ll Cover You

To qualify for cyber insurance and to avoid having a claim denied, insurance providers expect your business to have specific security controls in place. These are no longer “nice-to-have” features. They are considered minimum requirements for any business seeking coverage.

Below are the most common technical and procedural safeguards carriers expect to see.

Multi-Factor Authentication (MFA)

Insurers want to see MFA enabled for all critical systems, especially for:

MFA significantly reduces the risk of unauthorized access, making it one of the most critical security controls you can implement.

Data Backup and Recovery Plan

You must be able to demonstrate that your business:

If your backup fails during a ransomware attack and you cannot recover, your claim may be rejected.

Endpoint Protection and Network Security

Carriers will expect your devices to be protected by:

They may also ask for evidence that these systems are monitored and maintained by qualified IT staff or a managed provider.

Employee Cybersecurity Training

Human error is still the number one cause of breaches. Insurance providers want to know your employees:

Some policies now require annual training to remain compliant.

Documented Incident Response Plan

Having a formal, written plan shows that your business is prepared to:

An incident response plan is not just about satisfying insurers—it also improves your recovery time and reduces losses.

How SORA’s SERVD I.T. Services Prepare You for Cyber Insurance

Meeting the requirements for cyber insurance can feel overwhelming, especially if you are not sure where your current systems stand. That is where SORA Partners comes in. Through our SERVD I.T. program, we help businesses build the foundation they need not just to get coverage, but to maintain it with confidence.

Here is how we do it.

Complete IT Health Check and Compliance Assessment

We start with a full review of your systems, policies, and risks. This includes:

You will receive a clear report outlining where you stand and what gaps need attention.

Implementation of Best Practices

Once we know where the gaps are, we work with you to implement critical security measures such as:

These controls align directly with what insurers want to see and what your business needs to stay protected.

Documentation and Audit Support

Insurers will ask you to complete security questionnaires or provide proof of compliance. We help you:

This turns a tedious insurance process into a guided, efficient task.

Ongoing Monitoring and Maintenance

Cybersecurity is not a one-time fix. Our team provides 24/7 monitoring, monthly patching, user access reviews, and backup validation so you remain compliant and ready for whatever comes next.

With SERVD I.T., you do not just meet cyber insurance requirements. You build a more resilient business that is ready to respond, recover, and grow.

Compliance Isn’t Optional If You Want Protection

Cyber insurance is a powerful safeguard, but it’s not a guarantee. To get covered and stay covered, your business needs to demonstrate that it takes cybersecurity seriously. That means more than just installing antivirus software or using cloud storage. It means aligning your IT environment with the controls and best practices insurers now require.

From backup and recovery to access controls and employee training, every part of your cybersecurity program affects your eligibility, your premiums, and your ability to collect on a claim when it matters most.

At SORA Partners, our SERVD I.T. program is designed to help you meet those requirements with confidence. We do the heavy lifting, from assessments to implementation, so you can focus on running your business, knowing you are protected and prepared.

Not sure if your current setup meets today’s cyber insurance standards?

Schedule a free compliance readiness review with SORA Partners today.

Contact us today or call (310) 734-2572 to get started.